Legend:

GMOs allowed

GMO cultivation prohibited, import allowed

GMOs completely banned

Data not available

Proposition of Value

Type 2 Diabetes Mellitus currently affects 400 Million people worldwide, with an estimated growth by one third until 2045, especially in arabic and african states. This is highly alarming, since the neurological and cardiovascular threats associated with Type 2 Diabetes Mellitus will not only cost millions of lives world-wide, but will also be a burden to public health systems with annual costs already exceeding 200 Billion USD [1].

The GLP-1 analogues available on the market are sold by AstraZeneca, Sanofi, Eli Lilly and Novo Nordisk. These products are injectables which need to be administered twice daily to once weekly. However, Novo Nordisk was granted permission by the FDA to start placing its oral GLP-1 analogue Semaglutide/ Rybelsus on the market, which is predicted to strengthen Novo’s pioneering position in the race for the most effective Diabetes treatment [3]. While Novo’s investors suspect the pricing of the new product to be in the range of 26 USD per day, prices of 10 USD per day would also be feasible [5].

We will use the self-propagating E. coli Nissle 1917 as a production platform for scale-up and growth, formulated for optimal incorporation into the human microbiome.

The CRISPR/Cas3 kill switch designed by our team will make the application of living GMOs as treatment possible, since it prevents their release into the environment. This kill switch can be applied in a broad variety of projects/applications, it is also of great interest to other researchers and companies. Hence, we can use it to finance our own research and trials by providing a service to include the kill switch into diverse applications.

SWOT - from an idea to an opportunity

To evaluate whether our idea is just an idea or whether there are marketable opportunities, we performed a SWOT analysis.

Current Diabetes Mellitus Treatment

Currently, human Insulin and its analogues make up the largest margin of Diabetes treatments (54%) in Germany. However, GLP-1 analogues represent an increasing percentage of total sales, with a rise by 17.6% from 2016 to 2017 [2].

The GLP-1 analogues available on the market are sold by AstraZeneca, Sanofi, Eli Lilly and Novo Nordisk. These products are injectables which need to be administered twice daily to once weekly. However, Novo Nordisk was granted permission by the FDA to start placing its oral GLP-1 analogue Semaglutide/ Rybelsus on the market, which is predicted to strengthen Novo’s pioneering position in the race for the most effective Diabetes treatment [3]. While Novo’s investors suspect the pricing of the new product to be in the range of 26 USD per day, prices of 10 USD per day would also be feasible [5].

Our Product - GLP.exe

In contrast to anything available on the market, our product consists of dried, living E. coli Nissle 1917 within acid-resistant capsules.

Within the intestines, after the capsules have dissolved, the available bacteria will respond to changing levels of glucose, activating the synthesis of Exendin-4. At the human pancreas, Exendin-4 will cause an increase in insulin secretion. Consequently, our drug would help overcoming the relative lack of insulin in Type 2 Diabetes Mellitus, promote an anti-inflammatory environment and additionally support the patients’ weight-loss through the inhibition of hunger.

For biocontainment, a security mechanism killing the bacteria when recognizing a different environment than the human gut, was added.

Unique Selling Point of GLP.exe

Compared to injectables, GLP.exe does not require a parenteral application, thus customer compliance and therefore therapy success will be way more likely. Similar to Novo’s product, it will not require more than the daily oral intake of a tablet, possibly even less frequently if the patient’s microbiome is very susceptible to the treatment.

Contrary to the big pharma companies, we will not sell a pure pharmaceutical product, but a nutraceutical with additional positive effects through the bacteria’s probiotic characteristics.

Since Diabetes is known to also cause inflammatory manifestations within the intestines, Nissle’s anti-inflammatory features may have the potential to reduce GLP-1 side effects, e.g. digestive problems.

Intellectual Property

Together with Dr. Rolf Hecker from the Institute of Technology transfer in Tübingen, we evaluated the options to protect our idea. Due to iGEM’s Creative Commons license, our published project cannot be protected by patenting.

However, in-depth knowledge on the probiotic E. coli Nissle 1917 and the high flexibility of a startup could allow us to design a bioreactor platform and to adjust the growth media specifically for the strain, rendering commercial production more efficient. Products of these adjustments could be protected as patents.

Market Analysis

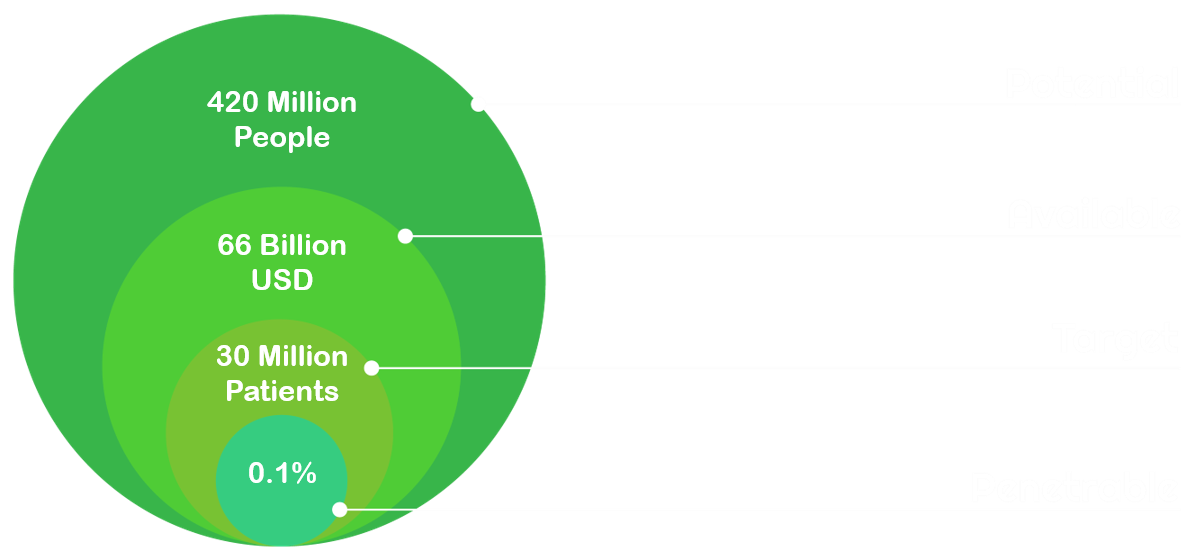

Potential market: 420 Million people worldwide suffering from/affected by Diabetes

More than 420 Million people worldwide are diagnosed with diabetes mellitus, with 90% being classified as type 2 [7]. Additionally, more than 1.9 Billion adults are overweight and 650 Million worldwide are classified as obese, thus eligible customers for our product [6].

The economic burden of Diabetes, described in worldwide Diabetes associated costs, is 727 Billion USD [7].

Available Market: 66 Billion USD spent on Diabetes treatments in 2016

The market of Diabetes treatment exceeded 66 Billion USD in 2016, with an estimated growth of 8-11% per year to 95 to 110 Billion USD by 2021 [8].

Target Market: 30 Million patients using GLP-1 analogues

GLP-1 analogues currently make up approximately 8% of the treatment market. Moreover, a growth by 17% in the year 2016-2017 compared to the previous year was observed [2].

The exemplary cost per patient per year with a GLP-1 analogue treatment like Liraglutid would exceed 1 700 USD [9]. Thus, 40 years of treatment would result in 70 000 USD treatment costs per person.

Penetrable market: gaining access to 0.1% of the market for GLP-1 analogues

The estimated value per patient per year is above 1000 USD, when providing a cheap alternative to Liraglutid.

Considering that only 8% of the Diabetes treatment market is governed by the GLP-1 analogues, this leaves a market of about 30 Million patients. Calculating a low but initially realistic market penetration of 0.1%, this would approximate 300 000 customers. Of those customers, 10% would have a positive perception of GMOs [10] and would therefore consider using our product. Hence, 30 000 patients per year with a 1000 USD value would result in 30 000 000 USD per year as penetrable market.

Value per patient: 1000 €/year

Customer Profile

Our average customer would be a Type 2 Diabetes Mellitus patient, potentially slightly overweight, who wants to profit from the positive side effect of weight loss of GLP-1 analogues. He or she would appreciate not having to use syringes for the application of the treatment. However, the new oral option provided by Novo with 20 USD per day might be way too expensive. Thus, our customer would be looking into cheaper alternatives, finding us, GLP.exe.

Being open-minded about the use of GMOs, they may try our product, realizing that general well-being due to the product’s probiotic effects come along with the treatment. Since well-being and the positive feedback via induced weight-loss will probably lead to a very good experience for our customer, he or she may spread word through social media accounts with other people in their network.

Economic Evaluation

i) Running costs

Together with Synovo, we worked out the running costs of a laboratory designed for development and proof of concept. A laboratory with one facility for production, one facility for analytics, a storage room and an office will cost approximately 100 000 USD per year in rent. Salaries for one postdoctoral researcher and two technical assistants would amount to 150 000 USD per year with social security included. Additional laboratory equipment will probably amount to 20 000 USD of extra costs, while general usage of consumables will reach about 50 000 USD a year. Thus, the total running cost of a small laboratory for one year will amount to 320 000 USD. If ISO 9001 quality control or patents are maintained, additional costs will arise.

To finance the early stages of development, funding, especially through the state and european grants - as described in the next section - will be necessary.

As soon as the stage of preclinical trials is reached, an animal facility will have to be rented and maintained. This will increase the annual costs by approximately 150 000 USD, since a new professional worker ,as well as additional consumables will be necessary. Funding could be provided more easily, since, at this stage, proof of concept will have occurred, making us eligible for grants like the ERC proof of concept grant.

After preclinical trials, clinical trials will have to be conducted. Costs will potentially exceed several Million USD, since Good Manufacturing Practice in accordance with the European Medicines Agency must be implemented. Thus, quality control management (quality control officials, testing, validation), GMP-equipment and packaging for the therapeutic are required. Simultaneously, further research and the implementation of the CRISPR/Cas 3 kill-switch will occur in order to provide financial support. However, debt capital will probably still be necessary.

ii) Production costs

The final product’s economic viability was estimated by calculating the cost for the production of one treatment. 5 Billion E. coli Nissle per 5g formulation represent the standard formulation of probiotics in market research [11]. The production of 5 Billion Nissle grown in 50 ml of LB medium costs approximately 0.13 USD, based on an approximation of costs for the media of about 30 USD per 250g, from which we can produce the content for 250 capsules. The capsule itself has a value of 0.5 cents (100 000 capsules cost about 500 USD [12]). Consequently, material costs will not exceed 15 cents per capsule.

Thus, if daily application of the probiotic was required, annual production costs for the treatment would not exceed 50 USD per patient.

Considering a consumer base of 30 000 people, annual materials required for the production of the therapeutic would amount to 1.5 Million USD. Adding approximately 640 000 USD of annual GMP-facility running costs, the total expenses for one year of production would be an estimated 2.2 Million USD.

iii) Pricing

Since the annual production costs for 30 000 customers would amount to 2.2 Million USD, the price per capsule must at least be 20,09 cents to prevent financial losses. Pricing of 1 USD per capsule would already produce an estimated revenue of 8.8 Million USD per year, which would be enough to meet the liabilities to creditors, pay taxes, invest in further research and to scale up the production facilities.

Overall, the financial calculation for GLP.exe supports our aim of providing an inexpensive alternative to any GLP-1 analogue available on the market.

Partnerships and Funding

Getting access to venture capital is key when funding a biotechnological start up in Germany. Thus, we looked into different governmental funds and discussed financing possibilities for start-ups with Synovo.

The Institute of Technology Transfer Tübingen

The Institute of Technology Transfer of the University Tübingen aims to support young scientists in filing patents and starting businesses. They are currently supporting us in strategy and concept development. Furthermore, they are happy to help us with filing a patent as soon as we have developed prototypes suitable for the filing process (Human Practices / Experts).

The EU Horizon 2020 funding programme [4]

The Horizon 2020 is a funding programme for research and innovation. The initiative was started in 2014 and lasts until 2020, with 80 Billion Euros (88 Billion USD) as total budget. Any european research project is eligible to apply. From Synovo, we heard that a support of 500 000 euros (550 000 USD) by the fund is possible, thus an application and a grant would be a great opportunity for financing materials, salary and laboratory equipment.

The EXIST-Scholarship for Start ups of the Federal Ministry of Economic Affairs and Energy [14]

The EXIST scholarship supports young scientists in realising their business ideas. One of the scholarship requirements is having a scientific project with a unique selling point and the potential for economic success.

The scholarship would include getting access to a network of founders, a salary for the founders for one year, a maximum of 11 000 USD for materials as well as 6 500 USD worth of coaching to initiate the business phase

Overall, the scholarship would be a great starting point for the transition of our idea into a viable business.

GO-Bio Promotion by the Federal Ministry of Education and Research [15]

The GO-Bio promotion aims to support life scientists who plan to go into business. As soon as we have professionalised our team, we would be eligible for funding. The fund would promote the founders’ entrepreneurial qualities and would open the door to private funds. Generally, the GO-Bio fund provides 15 to 30 Million USD per round, which will be distributed among the projects funded, depending on the respective requirements.

European Research Council ERC Proof of Concept Grant [16]

To be eligible, we would require professional scientists and first of all to be accepted into their frontier research project program in order to apply for the Proof of Concept Grant. If the application for both programs was successful, funding would cover the expenses of turning research into a business in the pre-competitive development stage. The financial support provided by the ERC Grant would be provided in the beginning of the funding period of 18 months as a lump sum of 160 000 USD.

Business strategy and Timeline

To form a strategy for our business, we talked to Dr. Hecker and our experts at Synovo.

2020-2021

First, we will have to produce convincing data and proof of concept. Consequently focusing on evidence for drug delivery and pharmacological activity, as well as providing data on the advantages of a probiotic delivery model . If we could proof the superiority of our product, big pharmaceutical companies may be interested in a collaboration. Moreover, our design of the CRISPR/Cas3 kill switch could be introduced to multiple different applications in order to finance our research. Moreover, state and european grants could be a beneficial source for capital.

2022-2025

As a next step, safety data will have to be generated in preclinical trials. This could also be done in collaboration with Synovo, since the company provides pharmacological and safety evaluation of drugs. At this stage, investors providing venture capital will be necessary in order to finance the trials.

2025-2030

After safety evaluation has been successfully completed, our product would be ready for clinical trials. To finance the huge expenses of a clinical trial, debt capital will probably be required. Another option would be the exit strategy.

From 2030

Since the law in the European Union is very prohibitive in using GMOs as therapeutics, Dr. Hecker proposed to look into different countries and search for a collaborator, who does not have to face these barriers. According to a research paper of the Law Library of Congress [17], Egypt has very low barriers for the market entry of GMOs in agriculture and therapeutics (see header image), thus a preliminary release in the arabic and african areas would be beneficial to generate revenue to pay our liabilities. Moreover, obesity and Diabetes rates are continuously rising in arabic and african states [7], while especially in african states the placement of our product in the low pricing section is essential. At the same time, we will work on the release in the European Union and states with more prohibitive regulations.

References

- Byetta (exenatide) – First-in-Class Incretin Mimetic for Type 2 Diabetes, accessed Septebmer 2019.

- IMS PharmaScope®, Basis: Umsatz in € zu AVP (Apothekenverkaufspreis abzgl. von Herstellerabschlägen und Einsparungen aus Erstattungsbeträgen und Apothekennachlässen inovo-nordisk-mit-semaglutide-zulassungshammer-jetzt-beginnt-eine-neue-aeram GKV-Markt, abzgl. von Herstellerabschlägen im PKV-Markt) , accessed: Septebmer 2019

- Novo Nordisk mit Semaglutide-Zulassungshammer: Jetzt beginnt eine neue Ära!, Vincent Uhr, Motley Fool, September 2019 , accessed: September 2019.

- What is Horizon 2020?, accessed: September 2019

- Pricing questions remain as Novo gets the nod for oral sema, Madelene Armstrong, September 2019, accessed: September 2019

- WHO, Obesity and overweight, 2018, accessed: September 2019

- IDF (International Diabetes Federation. IDF Diabetes Atlas. (2017). Eighth Edition.

- IMS QVIA Institute: Outlook for Global Medicines through 2021; December 2016

- Neues humanes GLP-1-Analogon Liraglutid, Deutsche Apotheker Zeitung, accessed: September 2019

- Public perception of genetically-modified (GM) food: A Nationwide Chinese Consumer Study. Kai Cui, Sharon P. Shoemaker npj Science of Food. Volume 2, Article number: 10 (2018)

- OMNI BiOTiC 10 Pulver, apotal.de, accessed: September 2019

- Evaluating Development and Production Costs: Tablets versus Capsules. Graham Cole, Capsule Library, accessed: September 2019

- Average hourly and weekly earnings of all employees on private nonfarm payrolls by industry sector, seasonally adjusted , accessed: September 2019.

- IMS EXIST – Existenzgründungen aus der Wissenschaft, accessed: Septebmer 2019

- Gründungsoffensive Biotechnologie, accessed: September 2019.

- Funding proof of concept, accessed: September 2019

- Restrictions on Genetically Modified Organisms. The Law Library of Congress, Global Legal Research Center (2014)